The stock market is a dynamic marketplace where individuals and organizations come together to trade shares, equity, and commodities. To a beginner, these terms may seem complicated, and the process of buying stocks and investing online is daunting. But with the right knowledge and techniques, anyone can invest in the stock market and work towards financial growth.

Understanding Equity:

Equity represents ownership in a company. When you purchase equity, you essentially own a fraction of the company’s assets and profits. That is why equity investment becomes so popular when one seeks wealth generation over long periods. Once an investor purchases equity, it opens avenues to share in a company’s growth, receive dividends, and realize appreciation in their holdings.

Buy Shares Online:

Buying stocks online has become easy. With a few clicks, you can create a trading account, add a bank account link, and get started on investment. This is a step-by-step guide.

Select the right broker

Select an online brokerage firm that has a low fee, an easy interface, and effective customer support. Compare the following features: research tools, educational resources, and account types.

Complete KYC Process

You will be required to provide your identity information before your buy stock online. Prepare identification and proof of address and submit them to complete the KYC process.

Fund Your Account

Fund transfer to the trading account. Plan a budget and strategy before getting started.

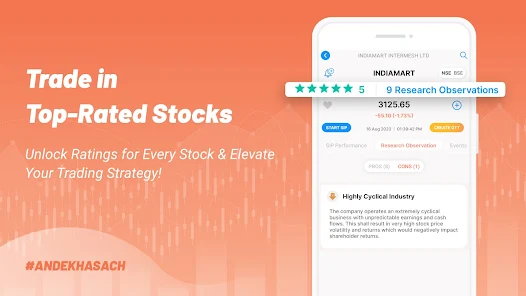

Searching for Stocks

You can look for stocks in the platform search bar. Based on your goals, you find a stock you like. The financial health, past performance, and growth opportunities of the company.

Execute the Trade

Determine how many shares you will buy and send in your order. You have the option to place a market order, that is, purchase at the going price or set a limit for a specific price.

What Is Commodity Trading?

Commodity trading involves buying & selling physical goods or raw materials. Unlike equity, which ties your investment to a company, commodities are influenced by supply and demand dynamics in the global market.

For instance, during a time of high inflation, commodities like gold tend to act as a hedge against volatility. Commodity trading diversifies this kind of investment so that one can hedge one’s risk in different classes of assets.

Why Invest in Stock Market?

Investment in the stock market is made with several benefits involved, such as:

- Gains Generation: Long-term investment in stocks and equity generates immense growth in capital through capital appreciation.

- Passive Income: Dividend-paying stocks will give you a steady income.

- Portfolio Diversification: Equity, shares, and commodities reduce the risk of overall investments.

- Liquidity: Stock is a liquid asset that can be bought and sold quickly within trading hours.

- Tips for First-Time Investors

- Start Small: Start with the amount you are willing to lose and gradually increase your investment based on your experience.

- Diversify: Diversify across different sectors in order to reduce the risk of investment.

Conclusion

Whether you are buying equity, exploring commodity trading, or purchasing shares online, investing in the stock market is a strong way to increase your wealth. With a grasp of the basics, the utilization of online tools, and the right information, you can comfortably start your journey into investment. The stock market provides opportunities for seasoned traders as well as novices to acquire financial freedom—one investment at a time.