The rise of digital platforms has made investing easier than ever before. An Online Trading App allows individuals to buy and sell securities directly from their smartphones without the need for complex systems. Whether you are new to the Share Market or have some experience, using an app can simplify the entire trading process. It provides access to real-time data, analysis tools, and order placements within seconds.

For beginners, the idea of trading may seem overwhelming. However, with a structured approach and clear understanding of the basics, anyone can learn how to trade effectively using an Online Trading App. This will explain simple ways to start trading, understand the Share Market, and use the app’s features efficiently.

Understanding the Basics of Online Trading

Trading through an app is based on the same principles as traditional stock market investments. The only difference is the platform. Instead of contacting a broker over the phone, you can directly place orders using your mobile device.

What is an Online Trading App?

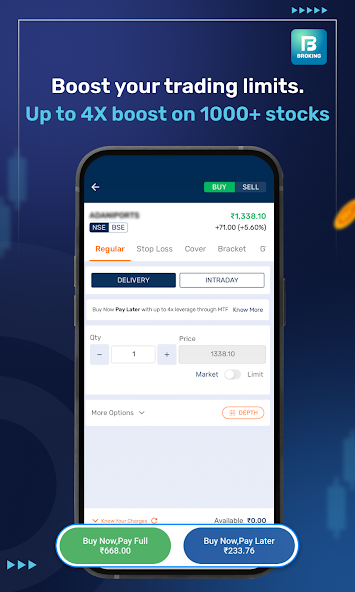

An Online Trading App is a digital platform that connects users with the stock exchange. It allows you to:

- View live market updates

- Track stock prices

- Place buy and sell orders

- Manage your portfolio

- Analyze market trends

It removes the barriers of time and place, letting you participate in the Share Market from anywhere.

Why Use an Online Trading App?

There are several reasons why traders prefer apps for managing their investments:

- Convenience of trading on the go

- Access to detailed market insights

- Low entry requirements compared to traditional methods

- Simplified order execution

- Portfolio management in one place

Simple Ways to Start Trading

If you are new to trading, it is important to follow a step-by-step process rather than rushing into the market.

Step 1 – Open a Trading Account

To begin trading, you need a trading account linked with a Demat account. The Demat account holds your securities electronically while the trading account is used to place buy and sell orders. Most Online Trading Apps guide you through this process with simple instructions.

Step 2 – Learn the Share Market Fundamentals

Before placing your first order, take time to understand the Share Market. Learn about:

- Equity shares

- Market indices

- Price movements

- Risk and return concepts

Gaining knowledge helps reduce errors and improves your decision-making while using an Online Trading App.

Step 3 – Start with Small Investments

Instead of investing a large amount in the beginning, start with small trades. This allows you to understand how the market behaves without taking unnecessary risks. Gradually, as you become familiar with the app and the market, you can increase your investments.

Step 4 – Use Research and Analysis Tools

Every Online Trading App comes with tools for research. These may include price charts, technical indicators, and historical data. Use them to evaluate the stocks before making any investment decision. Researching before trading helps you align your goals with market opportunities.

Trading Techniques for Beginners

Learning how to use different trading methods can help you maximize returns.

Delivery Trading

This method involves buying shares and holding them in your account for a longer period. It is suitable for investors who want to grow their wealth gradually.

Intraday Trading

In intraday trading, you buy and sell shares within the same day. The purpose is to take advantage of small price movements. While this offers opportunities for quick profits, it also carries higher risks. Beginners should approach intraday trading carefully.

Diversification

One of the simplest ways to minimize risks is by spreading your investments across different sectors. A well-diversified portfolio ensures that even if one stock underperforms, others can balance the losses. An Online Trading App makes diversification easier by allowing you to explore various industries.

Managing Risk in the Share Market

The Share Market is unpredictable, and risks are always present. However, with careful planning, risks can be managed effectively.

Set a Budget

Decide how much money you are willing to invest and stick to it. Avoid using borrowed funds or money set aside for essential expenses.

Use Stop-Loss Orders

Most Online Trading Apps allow you to place stop-loss orders. This feature automatically sells your stock if the price drops below a certain level, helping you limit losses.

Stay Updated

Market conditions can change quickly. Stay updated with financial news, company reports, and global events that may affect stock prices. Being informed helps you make better trading decisions.

Building Confidence with Online Trading

Trading requires patience and discipline. The more time you spend learning and practicing, the more confident you become.

Practice with Small Trades

Consistent small trades help you gain experience without the risk of major losses.

Keep Emotions in Check

Emotional decisions often lead to mistakes. Whether it is fear of loss or excitement of profits, try to base your trades on analysis rather than emotions.

Review Your Performance

Regularly reviewing your trades helps you identify what strategies work and what should be avoided. Over time, this builds a disciplined trading approach.

Conclusion

Trading in the Share Market does not have to be complicated. With the help of an Online Trading App, you can simplify the process and make informed decisions. Starting small, learning the basics, and using available tools can make trading easier and more effective.

By understanding the different methods of trading, managing risks wisely, and building confidence gradually, you can steadily grow your portfolio. An Online Trading App not only makes trading convenient but also gives you the resources to participate in the Share Market responsibly.