Understanding the stock market takes time, observation, and consistent learning. Many individuals begin their journey with enthusiasm but often struggle to build stable habits that support long-term progress. With the right approach, trading can become a structured activity rather than a guessing exercise. This provides clear and practical stock market tips to help individuals strengthen their trading skills while maintaining discipline and patience.

In recent years, interest in market participation has grown among new investors. People are exploring equity investments, long-term planning, and ipo investment opportunities. However, without preparation and knowledge, results can vary. By focusing on reliable methods and maintaining realistic expectations, individuals can gradually improve their performance and understanding. The following sections outline useful stock market tips that support skill development and better decision-making.

Understanding Market Basics

Before entering the market, it is important to understand how stock exchanges function and how prices change. Market movements depend on factors such as company performance, economic trends, global events, and investor behavior. Learning these elements helps traders avoid emotional decisions.

Learn How Stocks Work

Stocks represent ownership in a company. When investors purchase shares, they become partial owners. Prices rise and fall depending on demand, company results, and external influences. Beginners should spend time studying financial statements, earnings reports, and basic valuation methods. This knowledge forms the foundation for effective trading.

Follow Market Trends Carefully

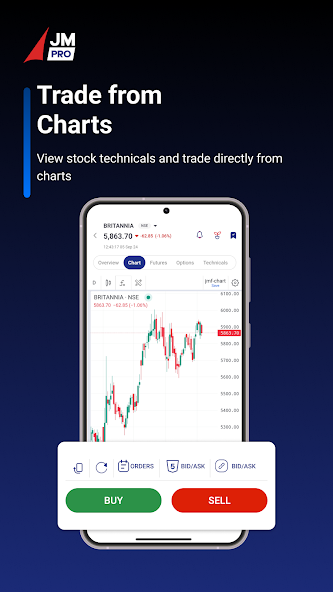

Observing daily market trends can help individuals understand how different sectors perform. Instead of reacting to every price change, focus on overall patterns. Studying charts and market data regularly helps traders identify potential entry and exit points. These habits support consistent learning and help apply stock market tips more effectively.

Building a Strong Trading Plan

A trading plan provides direction and helps reduce impulsive actions. Without a plan, individuals may enter trades without understanding risks. Creating a structured approach ensures that every decision aligns with clear goals.

Set Clear Investment Goals

Every trader should define their purpose for entering the market. Some aim for long-term wealth creation, while others prefer short-term trading. Defining goals helps determine the right strategy. Clear objectives also guide decisions related to position size, holding periods, and risk tolerance.

Manage Risk Carefully

Risk management is one of the most important stock market tips. Instead of investing all funds in one trade, diversify across sectors and companies. Setting limits on losses helps protect capital. Traders should decide in advance how much they are willing to risk on each trade and follow that plan consistently.

Maintain Discipline

Consistency matters more than occasional gains. A disciplined approach includes sticking to the plan, avoiding sudden decisions, and reviewing trades regularly. Maintaining records of trades can help identify patterns and improve future decisions.

Improving Trading Skills Through Practice

Trading skills develop gradually through observation and practice. Instead of expecting quick results, focus on learning from each trade. Reviewing both successful and unsuccessful trades provides valuable insights.

Study Historical Data

Looking at past market performance helps traders understand how different conditions affect prices. Historical charts reveal patterns that repeat over time. This process helps traders identify possible trends and prepare for similar situations in the future.

Use a Structured Approach

A structured method includes research, analysis, and decision-making based on data rather than emotion. Traders should evaluate company performance, market conditions, and sector trends before making a move. This process helps apply stock market tips effectively in real situations.

Stay Informed Without Overreacting

Following financial news helps traders remain aware of market developments. However, reacting to every headline can lead to unnecessary trades. Instead, focus on relevant information that affects long-term performance.

Learning About Ipo Investment

Many investors explore ipo investment as part of their market journey. Initial public offerings allow individuals to invest in companies at the time of listing. Understanding the process helps investors make informed decisions.

Research Before Applying

Before participating in any ipo investment, review company details such as financial performance, business model, and industry position. Studying these factors helps determine whether the opportunity aligns with personal goals.

Evaluate Listing Expectations

Prices may fluctuate during the listing period. Instead of expecting immediate gains, consider long-term potential. Some investors hold shares for extended periods to benefit from future growth. This approach supports stable decision-making and aligns with broader stock market tips.

Balance With Other Investments

While ipo investment can be part of a strategy, it should not replace diversified holdings. Maintaining a balanced portfolio helps reduce risk and provides stability during market fluctuations.

Avoiding Common Mistakes

Many beginners face challenges due to avoidable mistakes. Recognizing these issues early can improve overall performance.

Emotional Trading

Emotions such as fear and excitement often lead to poor decisions. Following a clear plan and using data-based analysis helps reduce emotional influence. Consistency in approach supports steady improvement.

Overtrading

Entering too many trades within a short period can increase risk and reduce focus. Instead, concentrate on quality trades that match your plan. This method aligns with effective stock market tips and supports skill development.

Ignoring Long-Term Learning

Trading is not a one-time learning process. Continuous education helps individuals adapt to changing market conditions. Reading market reports, analyzing charts, and reviewing strategies help maintain growth.

Strengthening Your Portfolio Strategy

A balanced portfolio supports stability and reduces exposure to sudden changes. Diversifying across sectors and asset types helps maintain consistency. Regular reviews allow traders to adjust holdings based on performance and goals.

Monitor Performance

Tracking portfolio performance helps identify areas for improvement. Reviewing results periodically ensures that strategies remain aligned with goals. Adjustments should be made carefully and based on analysis rather than short-term movements.

Stay Patient

Patience is essential for long-term success. Markets experience ups and downs, and results may take time. Consistent application of stock market tips helps build confidence and improve decision-making.

Conclusion

Developing trading skills requires time, patience, and structured learning. By focusing on research, planning, and disciplined execution, individuals can gradually improve their understanding of the market. Applying reliable stock market tips supports consistent growth and helps traders avoid common mistakes.

Exploring opportunities such as ipo investment can be part of a broader strategy when approached with careful research and realistic expectations. Maintaining a balanced portfolio and managing risks helps protect capital and supports long-term progress.

As individuals continue their market journey, revisiting fundamental principles and refining strategies can lead to better outcomes. Consistent application of stock market tips and thoughtful participation in ipo investment opportunities can help traders grow their skills and maintain steady progress over time.