Creating wealth is a purposeful and strategic process that requires advanced financial planning and a thorough understanding of investing ecosystems. In a time when financial markets are complicated, investors need to learn how to use different platforms, comprehend different types of investments, and create a strong and flexible strategy for building wealth.

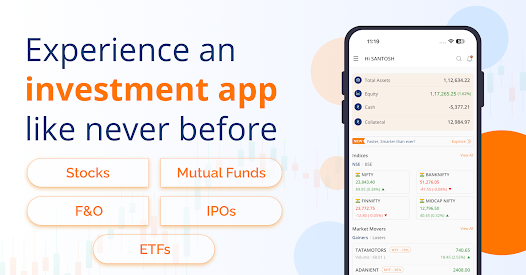

The current investment landscape provides unparalleled potential through the use of innovative mutual fund providers and digital investment platforms. People can achieve long-term financial success by using technical advancements and strategic financial tools to develop sustainable paths.

Foundations of Strategic Investment:

- Strategies for Mutual Fund Providers:

ICICI Prudential Mutual Fund offers a wide range of investment products that are designed to meet different risk profiles and financial goals. Investors can build portfolios that are tailored to their own financial objectives by using their varied fund categories, which allow for the creation of sophisticated, performance-driven portfolios.

- Platforms for Digital Investment:

5paisa Capital is an investment platform that is part of a new wave of platforms that make financial management accessible to everyone. These technical solutions include real-time market insights, smooth transaction capabilities, and advanced portfolio tracking methods.

Managing Risk and Diversifying Your Portfolio:

- Thorough Investment Strategies

HDFC Mutual Fund is a good example of a company that uses advanced diversification tactics. They let investors to reduce risks and maximise potential returns through smart asset allocation by providing plans across a variety of industries and asset classes.

Affordable Investment Options:

Angel One emphasises the importance of reducing investing costs. Smart investors pay attention to:

- Funds with a low expense ratio:

-Transaction costs are low.

-Fee schemes that are clear

-Investment choices based on performance

- Systematic Investment Planning:

SBI Mutual Fund emphasises the need of systematic investment plans (SIPs). These structured investment strategies offer:

- Consistent chances to invest:

-Market volatility averaging

-Steady growth of wealth

-Financial growth that is controlled

Advanced Investment Considerations Technology-Enhanced Investment Management like MF. Advanced technologies are used by modern investment ecosystems to:

- Offer market analysis in real time:

-Create investment recommendations that are tailored to you.

-Make it easy to manage your portfolio.

-Make financial judgements based on data.

- Ways to Optimise Your Taxes:

Smart investors put their money into tax-efficient investment tools that:

Reduce tax obligations:

-Get the most out of your post-tax returns.

-Make use of lawful methods to save on taxes.

-Be in agreement with the overall financial plan.

Important Principles for Building Wealth (Basic Guidelines for Investment):

- Start investing as soon as possible:

-Keep your investing discipline consistent.

-Consistently examine and rebalance portfolios.

-Keep yourself updated on market trends.

-Keep improving your understanding of finance.

- Managing Risk and Being Flexible (Holistic Wealth Creation Approach)

In order to develop money over the long term, you need to:

-Thorough financial planning

-Comprehending one’s own risk tolerance

-Adaptability in investment approaches

-Ongoing learning and adjustment

Conclusion:

Building money over the long run goes beyond standard saving approaches. It requires a complex, technology-driven approach that includes strategic planning, a variety of investments, and ongoing financial education. Individuals can build strong financial futures by using modern mutual fund providers and digital investment platforms.

Creating wealth is a personal and dynamic journey that takes commitment, expertise, and strategic thinking. To be successful, you must comprehend the complexity of the market, stick to disciplined investment methods, and be adaptable in a financial landscape that is always changing.